Bitcoin Miners Seize Opportunity as Mining Rig Prices Hit All-Time Lows

Author: Grace Thompson

- July 27, 2023

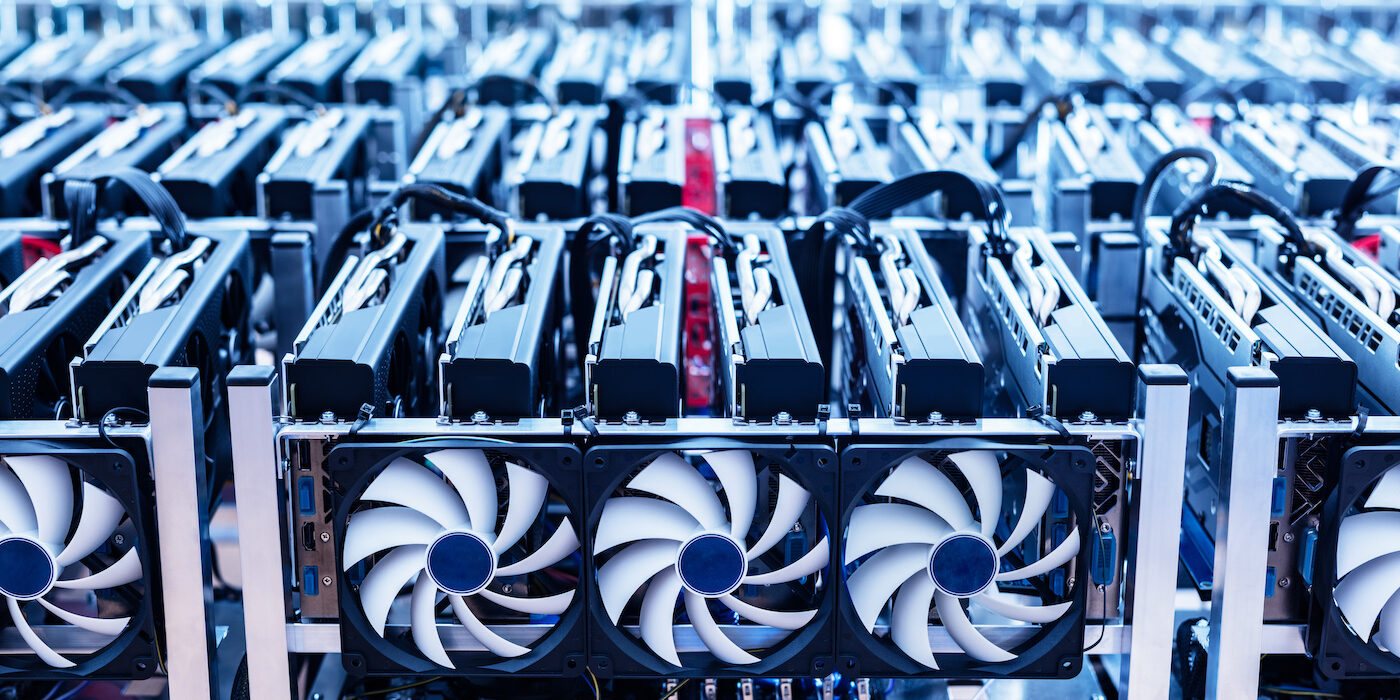

The prices of bitcoin mining rigs, crucial hardware used to validate and add new blocks to the Bitcoin blockchain, have recently plummeted to near all-time lows. This drop in prices is a result of declining profitability in the mining industry, caused by factors such as bitcoin price volatility, rising energy costs, hash rate growth, and increased network difficulty.

According to Colin Harper, content head at Luxor Mining, when mining rigs generate less income, their prices decline accordingly. The latest generation of mining rigs, exemplified by Bitmain’s S19 XP and WhatsMiner M50S series, boasting energy efficiency of 25 joules or less per terahash (TH) of computing power, have seen a significant price decrease. Since July 2022, prices have fallen by a staggering 66%, from $60 to $20 per TH, as reported by Luxor Mining’s Hashrate Index data, which measures mining rig prices in dollars per terahash of mining power.

Even older models of bitcoin mining rigs are experiencing price drops, in line with the decrease in bitcoin’s hash price – a measure of profitability that takes into account network difficulty, price, energy costs, block subsidies, and transaction fees. This hash price has been steadily decreasing over the past year, leading to a reduction in the prices of mining rigs.

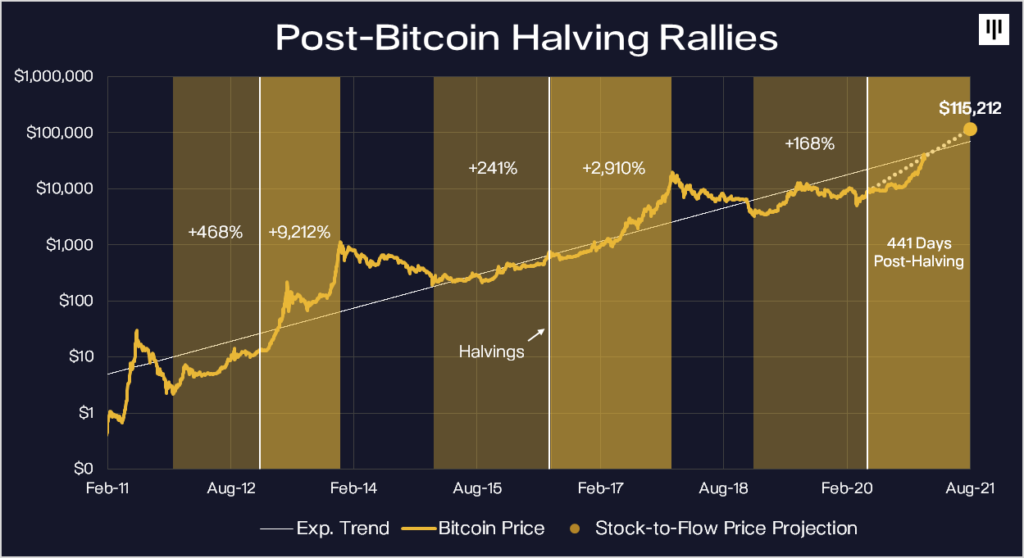

The decline in mining rig prices coincides with miners’ preparations for the fourth Bitcoin halving, expected in April 2024. The halving, which occurs approximately every four years, reduces the reward for successfully mining a bitcoin block by half. This measure is built into the blockchain’s code to regulate its supply economics. As the number of bitcoins mined approaches the predetermined cap of 21 million blocks, the rewards will eventually reach zero. The upcoming halving is projected to lower the reward to 3.125 BTC per block, down from the current 6.25 BTC.

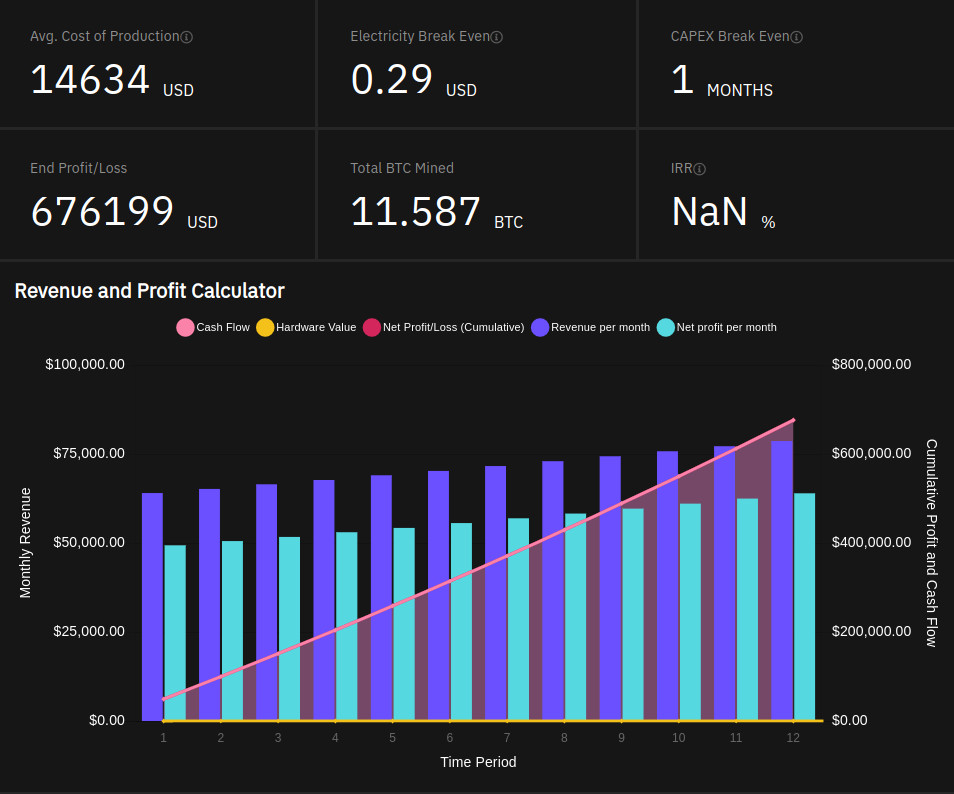

Miners are aware that after the halving, they will face nearly double the mining costs while trying to achieve the same revenue. To mitigate this challenge, they will need more efficient machines that can help reduce costs. Currently, it costs between $10,000 to $15,000 per bitcoin to profitably mine a block, but after the halving, this cost could rise to as high as $40,000 per bitcoin, according to analysts. Thus, using the most efficient machines will become a necessity for miners.

The recent drop in prices for newer-generation mining rigs has presented an opportunity for some miners to invest in the machines they will require to maintain profitability post-halving. For example, CleanSpark acquired approximately $145 million worth of Bitmain Antminer S19 XPs in April.

As the halving approaches, miners are increasingly realizing the importance of upgrading to newer-generation machines with higher efficiencies and computing power compared to older models. Consequently, prices for these high-efficiency rigs, which consume under 25 J/TH, have seen a 5% increase in the past month, according to Luxor data.

In conclusion, with mining rig prices reaching all-time lows, miners are making strategic moves to secure cost-effective and efficient machines to stay competitive after the upcoming Bitcoin halving.